SERVICES & FEES

CARLSON ALTERNATIVE INVESTMENTS

offers a holistic approach and end-to-end wealth management and product solutions, expertise, and technologies – from accumulation to preservation to distribution through a single point of contact. We assist our clients (if needed) in establishing accounts with the appropriate broker-dealers (custodians) that offer the world’s most sophisticated self-serve platforms for high-net-worth investors.

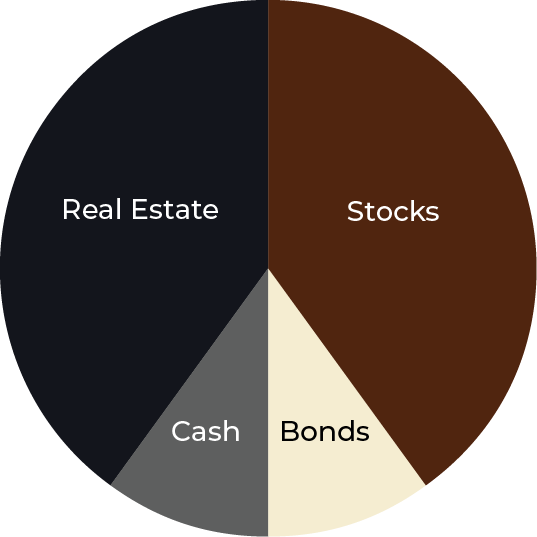

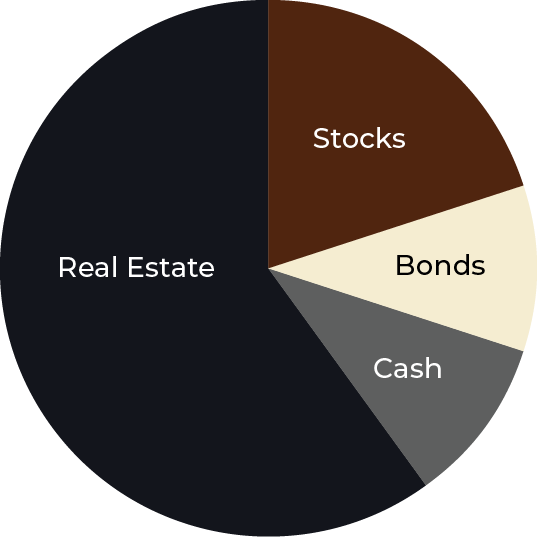

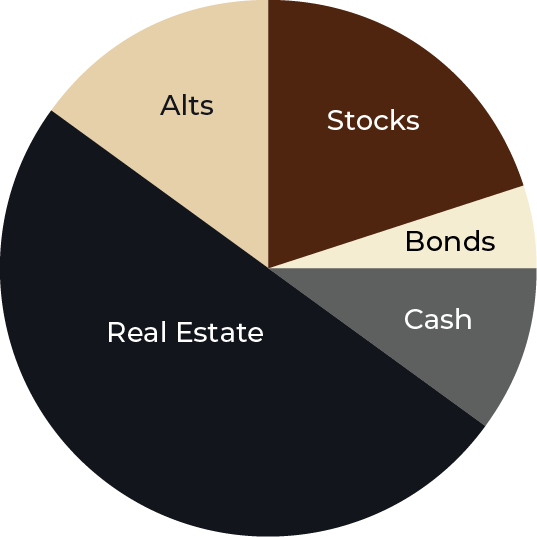

DISCLOSURE: The below asset class allocation pie graphs are representative of most CARLSON ALTERNATIVE INVESTMENTS and REALTY YIELD clients.

BALANCED

REAL ESTATE WEIGHTED

REAL ESTATE WEIGHTED

& HIGH-NET-WORTH

Please note that the above asset class allocation pie graphs are only examples and will vary by the investor.

SERVICES

List of Services

-

STEP 1 - AssessmentList Item 1

We will start by getting a clear understanding of our investor client’s current situation in relation to where they want to be. That requires a thorough assessment of current assets, liabilities, cash flow, and investments factoring the investor's most important goals. Goals need to be clearly defined and quantified so that the assessment can identify any gaps between the current investment strategy and the stated goals and objectives. This discussion sets the course for developing an investment strategy.

-

STEP 2 - Establish ObjectivesList Item 2

Establishing investment objectives centers on identifying our investor client’s risk-return profile. Determining how much risk an investor is willing and able to assume, and how much volatility the investor can withstand, is key to formulating a portfolio strategy that can deliver the required returns with an acceptable level of risk. Once an acceptable risk-return profile is developed, benchmarks can be established for tracking the portfolio’s performance. Tracking the portfolio’s performance against benchmarks allows smaller adjustments to be made along the way.

-

STEP 3 - Portfolio ConstructionList Item 3

Portfolio construction is the process of understanding how different asset classes, funds, and weightings impact each other, their performance and risk and how these strategic decisions correlate to an investor’s objectives and goals. Advisors and investment managers often use strategic asset allocation—a process whereby a portfolio is weighted by specific percentages to certain areas. A focus on achieving diversification at a reasonable cost is important to managing risk while maximizing returns based on a client’s objectives and constraints. The challenging part of the process is understanding what kind of strategic asset allocation is in the client’s best interest.

-

STEP 4 - Investment SelectionList Item 4

Individual investments are selected based on the parameters of the Portfolio Construction (asset allocation strategy). The specific investment type selected depends in large part on the investor’s preference for active or passive management. An actively managed portfolio might include individual stocks and bonds if there are sufficient assets to achieve optimum diversification, which is typically over $1 million in assets. Smaller portfolios can achieve the proper diversification through professionally managed funds, such as mutual funds or exchange-traded funds. An investor might construct a passively managed portfolio with funds selected from the various asset classes and economic sectors. For those favoring income-producing real estate the options are direct investment and/or fund investment.

-

STEP 5 - Monitor, Measure, and Rebalance

After implementing a portfolio plan, the management process begins. This includes monitoring the investments and measuring the portfolio’s performance relative to the benchmarks. It is necessary to track investment performance at regular intervals, typically quarterly, and to review the portfolio plan annually. Once a year, the investor’s situation and goals get a review to determine if there have been any significant changes. The portfolio review then determines if the allocation is still on target to track the investor’s risk-reward profile. If it is not, then the portfolio can be rebalanced, selling investments that have reached their targets, and buying investments that offer greater upside potential. When investing for lifelong goals, the portfolio planning process never stops. As investors move through their life stages, changes may occur, such as job changes, births, divorce, deaths, or shrinking time horizons, which may require adjustments to their goals, risk-reward profiles, or asset allocations. As changes occur, or as market or economic conditions dictate, the portfolio planning process begins anew, following each of the five steps to ensure that the right investment strategy is in place.

Schedule your COMPLIMENTARY CALL

FEES

Mike is an expert in wealth-building through strategic portfolio construction and investment selection that includes equities, fixed-income vehicles, income-producing investment real estate and alternative investments. Founding his company on the philosophy that focused, one-on-one relationships with clients will yield superior results over the long-haul.

At CARLSON ALTERNATIVE INVESTMENTS, we help you navigate the complex world of alternative investments.

Mike Carlson

Founder, President & Chief Investment Officer